In the fast-moving arena of financial markets, volatility is both a friend and a foe. For seasoned traders, volatility offers massive opportunity — rapid price swings, breakout moves, and high-profit potential. But for many, it also brings a hidden risk: widening spreads. During major news events or unexpected global shifts, most brokers quietly open the gap between bid and ask prices, turning potential profit into painful slippage. That’s where IC Markets spreads prove their worth — staying remarkably tight even during high-volatility events.

This isn’t just a performance highlight — it’s a defining trait of IC Markets’ infrastructure, a competitive edge forged in the heat of market storms.

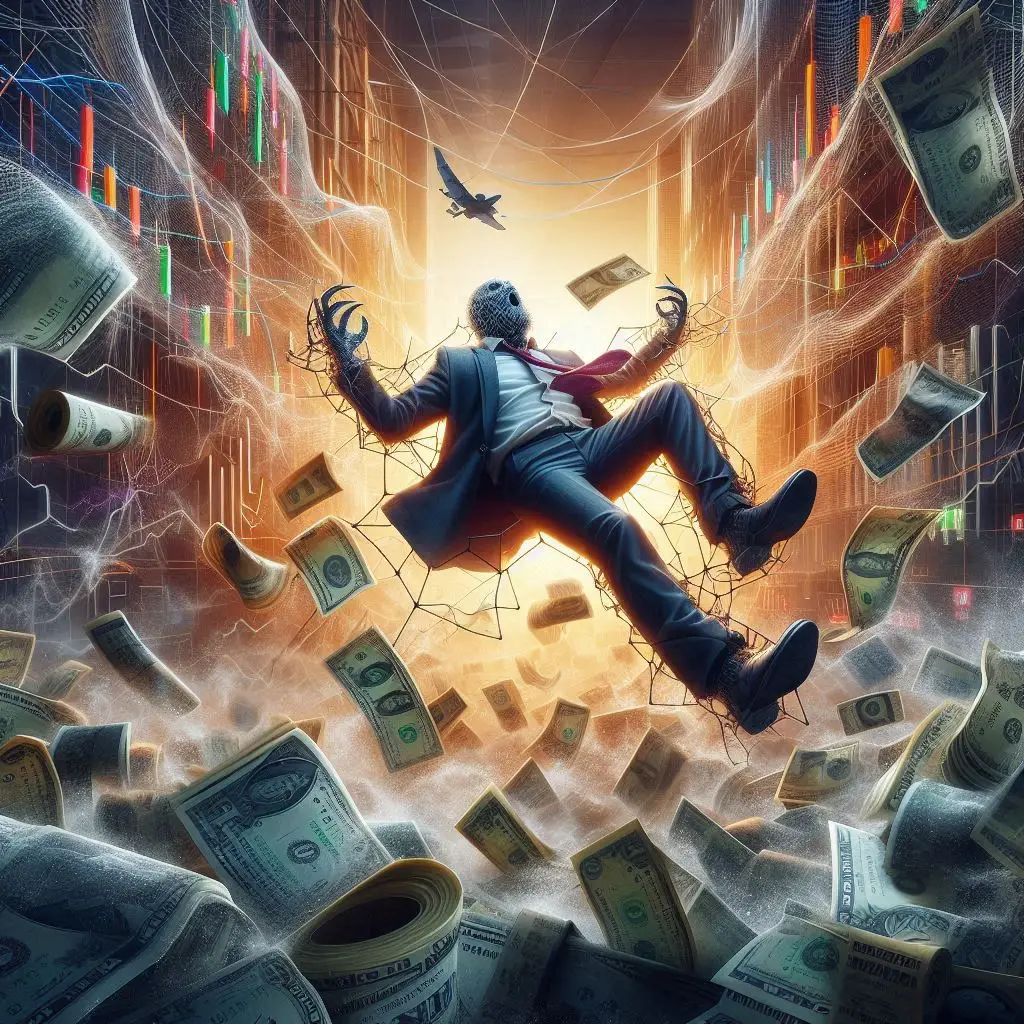

The Volatility Trap: Where Most Brokers Falter

Imagine a central bank announces an unexpected interest rate hike. Within seconds, the forex market erupts. Prices swing wildly. Traders rush in. And just when opportunity seems most alive, most brokers pull a silent trick — they widen the spread.

A pair that normally has a 0.9 pip spread suddenly stretches to 5, 10, or even 15 pips. This instantly increases your entry cost, slashes your profit potential, or worse — triggers stop losses that should’ve been safe.

This is a common volatility trap in retail trading.

IC Markets, however, is engineered differently.

IC Markets Spreads: Built for Storms, Not Just Sunshine

IC Markets’ infrastructure is anchored in a True ECN environment — meaning it sources real-time pricing directly from a global pool of 25+ top-tier liquidity providers. This massive depth ensures that:

- Even when markets go wild, there’s still competition between liquidity providers.

- Spreads on major pairs like EUR/USD, USD/JPY, and GBP/USD often remain below 1 pip, even during major news releases.

It’s like driving a race car through a thunderstorm — and still staying on track, thanks to a world-class suspension system.

News Trading Without the Spread Shock

For traders who specialize in news trading, IC Markets is a haven. During events like:

- FOMC announcements

- Non-farm payroll releases

- Inflation or GDP reports

- Central bank rate decisions

…you can execute trades without the fear of artificially inflated spreads.

This makes IC Markets spreads not just competitive, but reliable — a priceless quality when milliseconds and micro-movements matter most.

Low Latency Execution: A Partner to Tight Spreads

Maintaining tight spreads during volatility is one thing — executing trades at those spreads is another. IC Markets matches both.

Their trading servers are housed in Equinix data centers (NY4 & LD5), placing your orders within microseconds of market movement. This low-latency structure ensures:

- Faster order fills

- Minimal slippage

- Accurate spread exposure

It’s not just about having tight spreads — it’s about capturing them in real time.

Institutional-Grade Access for Retail Traders

Many retail platforms widen spreads to manage risk during volatile periods. IC Markets doesn’t have to — because its institutional-grade infrastructure absorbs and routes large volumes efficiently.

The result is a rare fusion:

- Retail trader access

- Institutional-level execution

- Tight spreads under pressure

This unique balance makes IC Markets a standout choice for serious traders who demand performance even in chaos.

Real Transparency During Real Market Moves

IC Markets doesn’t hide behind slogans. They publish historical spread data. You can analyze how spreads behaved during past market events — and confirm the consistency of their claims.

This level of transparency is rare in the industry — and it’s how IC Markets spreads earn genuine trust.

A Platform That Stands Tall When Others Collapse

In calm markets, most brokers appear equal. But during volatility — when the charts go wild, the traders go live, and the real money moves — only a few platforms hold the line.

This isn’t by accident. It’s the result of deliberate design, deep liquidity, smart routing, and a commitment to fairness.

If you’re tired of being blindsided by spread spikes during the moments that matter most, it’s time to trade with a platform that respects your edge.